When we hear the term “dumb money,” it’s easy to picture out-of-touch investors blindly throwing cash at anything that glimmers. But in recent years, the tides have turned, and these so-called “dumb money” strategies have rocked Wall Street like a bad Santa slipped on a banana peel. Retail investors—even those with little experience—have revealed that sometimes, a bit of fun, community, and pop culture can outmaneuver institutional giants. Let’s dive in and unpack the top seven dumb money secrets that shocked Wall Street’s elite, turning their suits into shambles.

Top 7 Dumb Money Secrets That Stunned Wall Street’s Elite

1. Meme Stocks: The Rise of Mad Money

Meme stocks like GameStop and AMC witnessed a surge that we would describe as nothing short of a mad max scenario. Retail investors, armed with nothing more than memes and social media savvy, sent these stocks skyrocketing, leaving institutional investors scratching their heads. It’s like the whole stock market turned into a rollercoaster ride, and the average Joe took the wheel. The takeaway? Ignorance can drive real change when combined with collective entertainment and cultural waves.

2. YouTuber Influence: The Boy Kills World Effect

Ever think a YouTuber could impact stock prices? Well, they did! Financial channels like Graham Stephan and Meet Kevin racked up followers by breaking down the complexities of investing into bite-sized nuggets that viewers can digest with their morning coffee. Their charisma and relatable advice mean that the finance game is no longer just for the corporate elite. It’s simple: everyday folks can harness knowledge from these powerful influencers and use it to navigate Wall Street’s wild waters like Monster High characters exploring a haunted house.

3. Badlands of Retail Investment: Navigating Risk

Even amidst exciting peaks of opportunity, the badlands of retail investment loom large. Platforms like Robinhood democratized access to the stock market, but they also exposed rookies to hefty risks. Think of it as a kid running into traffic while thinking it’s a game. It’s crucial for investors to grasp the stakes involved and approach with caution. No one wants to become roadkill in their pursuit of wealth. Therefore, the focus on education around risk management has never been more essential.

4. The Horrible Bosses of Wall Street: A Cautionary Tale

Wall Street hasn’t exactly had a squeaky-clean reputation. Scandals like Enron and Lehman Brothers reveal how corporate horrible bosses can lead institutions astray. Retail investors have increasingly turned to ethical investments as a response to these scandals, seeking out companies that prioritize transparency and accountability. This movement towards corporate responsibility shifts the narrative, showcasing that average investors care about ethics—who knew being a conscientious consumer could ripple through Wall Street?

5. The Serial Mom Approach to Investing: Long-Term Longevity

Ever heard of the Serial Mom approach? It’s about fostering patience in investment methods, similar to caring for children. Investors taking the long view, paralleling the nurturing of a relationship, witness the benefits of their patience when the market rebounds. Instead of chasing quick gains, they create a culture of mad happiness through wise, measured decisions. Stability pays off, reinforcing the idea that nurturing your investments is more important than living off adrenaline-fueled trades.

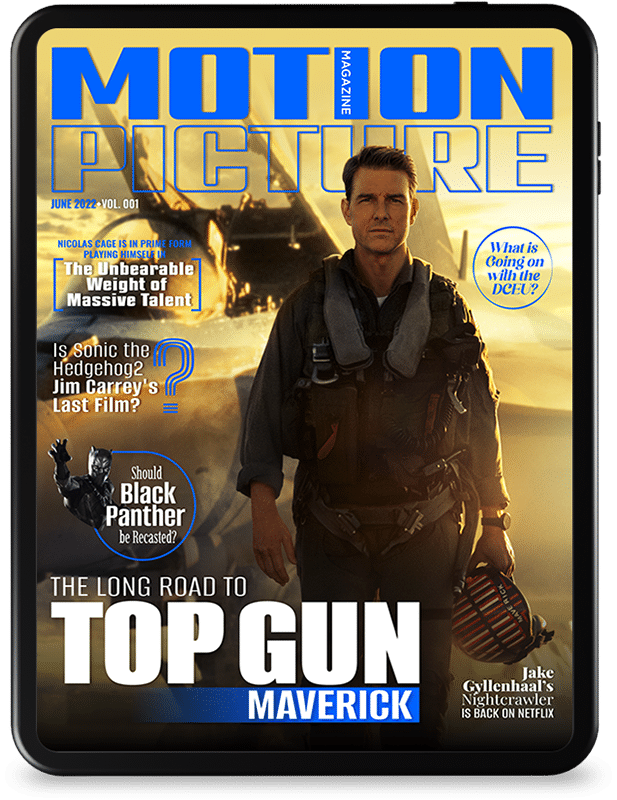

6. Streaming Wars and Bad Boys of Entertainment Investment

The streaming wars have turned traditional media stocks into battlegrounds. Companies like Netflix and Disney+ have altered the landscape, and retail investors must now make educated guesses about which services will thrive amid fierce competition. It’s a chaotic market where rapid changes can swing stocks in an instant. Stick with knowledge, and you might just score big, even if it feels like fighting the bad boys of standard entertainment.

7. The Role of Social Media: Baddies on the Digital Battlefield

Enter the brave new age of investing,where Twitter threads and TikTok clips reign supreme. Retail investors have emerged as baddies ready to challenge the norms. Think: WallStreetBets. These savvy digital crusaders have proven that unity and influence can change stock prices, initiating a battle against traditions that once favored institutional investors. Combining humor and quick wit with information, the narrative around investing has fundamentally shifted—community is queen!

The Future of Dumb Money in a New Era

As we charge into 2027, one truth stands firm: the world of investing is anything but static. Retail investors have blurred the lines between conventional wisdom and impulsive consumer passions. The idea that mere dumb money can outmaneuver expert predictions stands to reshape financial landscapes for years to come. Innovation, community, and a sprinkle of madness will shape our future, making the journey exciting and unpredictable.

Investors, whether armed with spreadsheets or memes, must adapt to these changes. The interconnection between retail and institutional investors continues to evolve, demanding agility from both sides as we forge ahead into this brave new world of finance. The days of sitting idly in waiting rooms are gone; it’s time to roll up your sleeves, hop onto the meme train, and be part of this wild ride. After all, who knew that at the intersection of culture and commerce, we could find the potential to make waves that even the most seasoned Wall Street titans couldn’t ignore?

So, strap in and keep your eyes peeled, because this financial rollercoaster isn’t showing any signs of slowing down!

Dumb Money: Trivia That’ll Blow Your Mind!

The Rise of Dumb Money

In the wake of the infamous meme stock phenomenon, the term “dumb money” has sparked curiosity far beyond Wall Street. This phrase refers to the retail investors—enthusiastic individuals who often buy stocks based on trends rather than traditional analysis. Interestingly, this group has gained traction through platforms like Reddit, where they share trading tips alongside discussions about pop culture, like the latest buzz surrounding Bad Moms and the comedic twists that tickle audiences’ funny bones. Imagine these investors chatting about their market moves while binging shows starring captivating actors like Sarah Shahi—it’s( a mashup of finance and entertainment!

Surprising Insights Behind Retail Investment

Did you know that “dumb money” isn’t as dumb as it sounds? While institutional investors often rely on deep analytics and algorithms, retail investors sometimes have an uncanny sense of timing, riding the wave of trends. They even adopt playful strategies like using Chanclas—or flip-flops—as a meme to symbolize their laid-back approach to investing. When viewer engagement spikes with bright-colored games like Atelier Ryza, it becomes clear that the intersection of gaming nostalgia and spontaneous trading can be quite a powerful cocktail. It’s all a wild ride, filled with both glitz and grit!

The Unexpected Power of Community

Nothing fuels “dumb money” quite like community support. Investors rally around each other, sharing insights and fostering camaraderie that rivals some of the hottest fandoms, like those for Lexi Rivera, as they bond over their love for viral sensations. The surge of communal buying power can shake traditional markets, sending stocks through the roof—seriously, it’s akin to the electrifying moments seen in popular shows and games such as Dead at Daylight. Plus, these retail investors often approach the market with a lighter touch, reminiscent of the carefree vibe experienced while laughing over a good comedy flick. It’s a fresh chapter in investing, where passion plays a significant role in shifting financial dynamics.

In short, the “dumb money” movement is all about combining heart with market savvy, ultimately challenging the status quo and showcasing that even light-handed investors can have a serious impact. Just look at Liam Gallaghers comeback—I mean, who would’ve thought?!